It was a typical Friday evening, and Priya, a young professional, scrolled through her favourite online store. A sleek smartwatch caught her eye—the perfect gadget to complement her fast-paced lifestyle. She added it to her cart, only to pause at the checkout page. The price tag wasn’t exactly wallet-friendly, and payday was still two weeks away.

Just as she was about to close the app, a small message popped up: “Buy Now, Pay Later. No Interest!” Intrigued, Priya clicked. Before she knew it, she was on her way to owning the smartwatch, with payments neatly split into four manageable installments.

This is the magic of Buy Now, Pay Later (BNPL)—a payment option that has taken the world by storm, redefining how people shop and pay.

What’s Behind the BNPL Buzz?

BNPL isn’t just a trend; it’s a game changer. It allows consumers to buy what they want now and spread out the payments over time, often without any interest. Unlike traditional credit cards with their complicated terms and hefty interest rates, BNPL is simple, transparent, and designed for today’s fast-paced, digital-first world.

Millennials and Gen Z, in particular, love BNPL. It aligns perfectly with their preference for flexibility and low commitment. For them, it’s not just a payment option; it’s a lifestyle choice.

The Flip Side of the Coin

But not everything about BNPL is sunshine and rainbows. Take Priya’s friend, Rohan, for instance. Excited by the ease of BNPL, he used it to finance everything—from gadgets to groceries. But he soon realized that missing a payment wasn’t just about late fees; it impacted his credit score.

In fact, statistics show that nearly 40% of BNPL users have missed payments, and for 72% of them, it has led to a credit score dip. The accessibility of BNPL, while empowering, also demands responsibility.

The BNPL Boom: What’s Next?

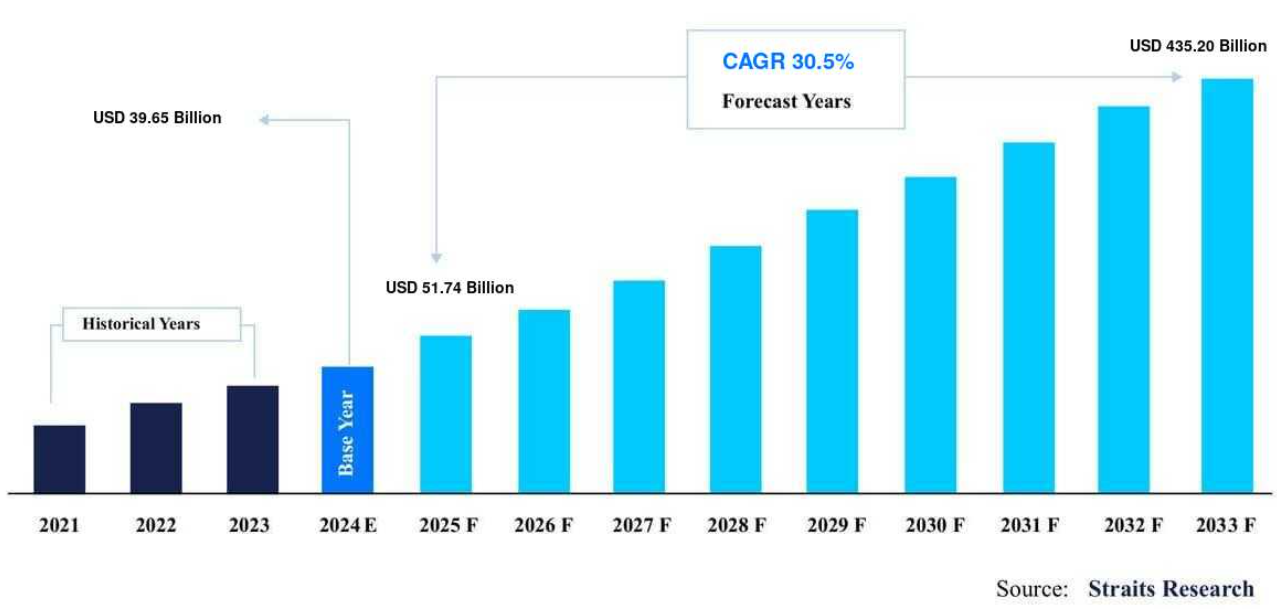

The BNPL market is witnessing unprecedented growth. Valued at USD 39.65 billion in 2024, it is projected to skyrocket to USD 435.20 billion by 2033, growing at a CAGR of 30.5% during the forecast period (2025-2033). With its ability to offer flexible and convenient payment options, BNPL is becoming an essential part of the financial ecosystem, reshaping consumer behavior and business strategies alike.

This meteoric rise is fueled by the growing demand for short-term financing solutions, enabling consumers to acquire daily necessities, expensive gadgets, and even school supplies with ease. Retailers are embracing BNPL to provide their customers with affordable financing options, driving sales and customer loyalty. Furthermore, businesses are leveraging BNPL platforms to finance operations like purchasing raw materials and paying staff salaries, contributing to the market’s expansion.

Bank of America Corp. estimates the BNPL market could grow 10-15 times by 2025, with more customers using it for both online and offline transactions. The burgeoning e-commerce sector is a significant driver, as retailers increasingly adopt point-of-sale and online installment loans to enhance customer experiences.

As technological innovations like AI, open APIs, and seamless app integrations continue to revolutionize BNPL, the industry is set to offer even faster and more user-friendly services. The future of BNPL is undoubtedly bright, opening up endless opportunities for consumers, businesses, and solution providers alike.

Riding the BNPL Wave Responsibly

For consumers like Priya, BNPL is a lifesaver, offering convenience and flexibility. For others like Rohan, it’s a wake-up call to tread carefully.

The key to embracing BNPL lies in balance—using it to manage cash flow without overextending finances. As regulatory frameworks evolve, ensuring consumer protection will be critical in sustaining BNPL’s appeal.

A New Era of Shopping

BNPL isn’t just about payments; it’s about empowerment. It’s about giving consumers choices, enabling businesses to thrive, and reshaping the way we think about spending.

For Priya, that smartwatch wasn’t just a purchase; it was a testament to how BNPL is changing lives, one installment at a time.

As we move forward, the potential for BNPL is limitless. Whether you’re a consumer, a retailer, or a financial institution, it’s time to join the revolution—responsibly, of course.

Happy shopping and remember: with great flexibility comes great responsibility!

Conclusion

The BNPL revolution is transforming the way we shop, making purchases more accessible and empowering consumers with flexibility and convenience. However, like any financial tool, it requires responsible usage to maximize its benefits and avoid pitfalls. As BNPL continues to reshape consumer behavior and business strategies, its future shines bright, promising opportunities for everyone in the ecosystem. Remember, while enjoying the ease of BNPL, balance and mindfulness are key to riding this wave responsibly.

Disclaimer: The content provided on this website is for informational and educational purposes only and does not constitute legal, financial, or investment advice. While we strive to ensure accuracy, the information regarding Buy Now, Pay Later (BNPL) services and market trends is based on publicly available data and should not be relied upon for making financial decisions. Always consult with a qualified financial advisor or conduct thorough research before engaging in any financial transactions or commitments related to BNPL services.

Disclaimer:

The information provided in this article is for educational and informational purposes only. While every effort has been made to ensure accuracy, readers are encouraged to refer to the latest Reserve Bank of India (RBI) guidelines and consult with qualified professionals for specific advice related to currency chest operations and compliance requirements. The examples and stories included are illustrative and may not represent actual events.